Publication

Article

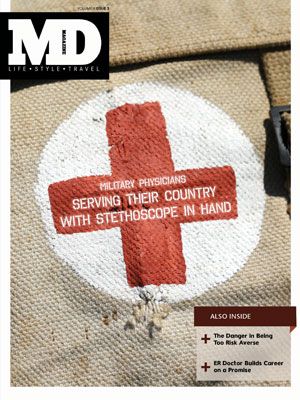

MD Magazine®

Pros, Cons of Investing in Private Equity Funds

Author(s):

Adding private equity funds to your portfolio can lead to higher returns and lower risk over the long term, but choosing a private fund takes much more due diligence than selecting a mutual fund.

Adding private equity funds to your portfolio can lead to higher returns and lower risk over the long term, but selecting a private fund takes much more due diligence than selecting a mutual fund.

Private equity funds are typically limited partnerships with a lifespan of about 10 years. Some have a minimum investment as low as $100,000 and are available to ordinarily affluent people; some are only for the ultra-wealthy. Because these funds are illiquid no one should invest in them unless he or she can easily handle funds being tied up for 10 years or more.

For the right investor, the rewards can be substantial.

Private fund managers can take a more active role with the companies they acquire and potentially wring out higher returns than mutual fund managers. They use leverage (borrowing), which can make for higher returns. Using leverage, the funds buy up companies, and the manager looks to markedly improve operations and profits.

The right manager

Investors should look for managers who generate returns by making significant operational improvements to portfolio companies, rather than those who rely on excessive leverage, which adds risk. However, with judicious use of leverage, a skilled manager can deliver excellent results.